On August 23, 2023, it was reported that Resources Investment Advisors LLC has acquired a new position in RBC Bearings Incorporated during the first quarter. According to the company’s recent filing with the Securities and Exchange Commission, Resources Investment Advisors LLC has purchased 2,108 shares of RBC Bearings Incorporated stock, valued at approximately $491,000.

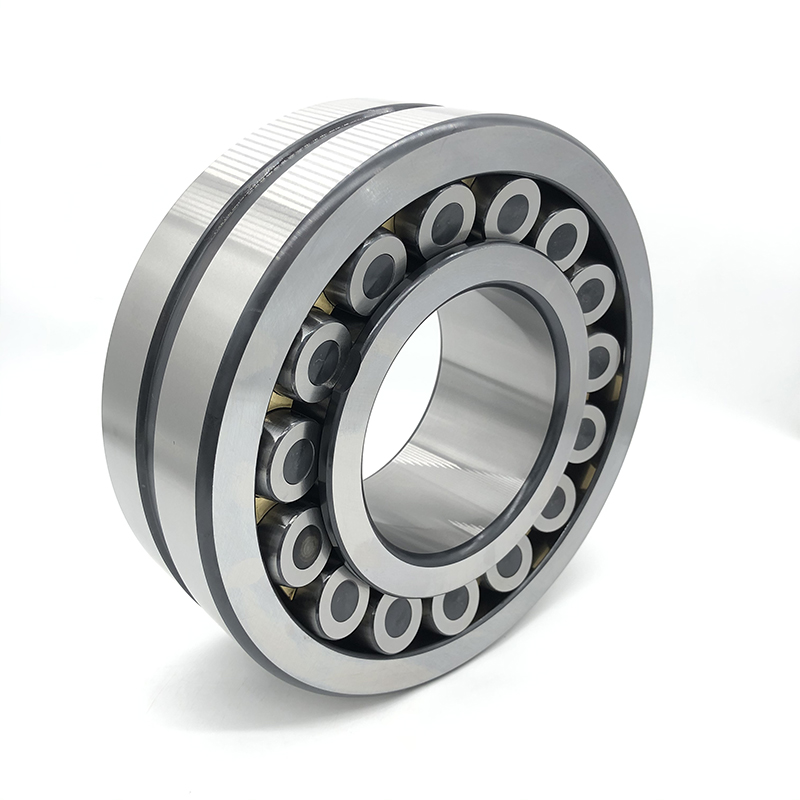

RBC Bearings Incorporated is a renowned manufacturer and marketer of engineered precision bearings and components. The company operates through two segments: Aerospace/Defense and Industrial. Its product portfolio includes various types of bearings designed for different applications such as plain bearings with self-lubricating or metal-to-metal designs, roller bearings, and ball bearings. Roller Ball Transfer Bearings

The plain bearings offered by RBC Bearings incorporate both self-lubricating and metal-to-metal designs, catering to specific needs in industries. The range includes rod end bearings, spherical plain bearings, and journal bearings. Additionally, the company produces roller bearings like tapered roller bearings which are commonly used in industrial applications as well as military aircraft platforms. Other roller bearing products include needle roller bearings, needle bearing track rollers, and cam followers. These anti-friction products serve diverse industrial applications effectively. Lastly, RBC Bearings manufactures ball bearing solutions that encompass high precision aerospace, airframe control, thin section, and industrial ball bearings. These ball elements are designed to reduce friction in high-speed applications.

In other news regarding RBC Bearings Incorporated, Director Michael H. Ambrose recently sold 400 shares of the company’s stock on July 19th. The average price per share was $220.00 resulting in a total transaction of $88,000.00. Following this sale transaction, Director Ambrose now holds 6,800 shares in the company valued at $1,496 (thousand). This sale was disclosed through a document filed with the Securities and Exchange Commission (SEC), which can be accessed via the SEC website. It is noteworthy that company insiders currently possess 2.90% of RBC Bearings Incorporated’s stock.

Overall, the acquisition of a new position in RBC Bearings Incorporated by Resources Investment Advisors LLC showcases growing interest and trust in the company. With its focus on precision bearings and components for various industries, RBC Bearings continues to play a significant role in the market. The recent insider transaction highlights the involvement of company management in the stock market as Director Ambrose sold a portion of his shares. As always, investors should conduct thorough research and analysis before making any investment decisions based on such information. RBC Bearings Incorporated RBC Strong Buy Updated on: 20/09/2023 Financial Health Very Healthy Debt to equity ratio: Buy Price to earnings ratio: Strong Buy Price to book ratio: Strong Buy DCF: Strong Buy ROE: Neutral Show more Price Target Current $237.95 Concensus $264.00 Low $235.00 Median $264.00 High $293.00 Show more Social Sentiments We did not find social sentiment data for this stock Analyst Ratings Analyst / firm Rating Morgan Stanley Buy Morgan Stanley Buy Truist Financial Sell Show more RBC Bearings Incorporated Attracts Attention from Institutional Investors and Analysts

Debt to equity ratio: Buy

Price to earnings ratio: Strong Buy

Price to book ratio: Strong Buy

RBC Bearings Incorporated, a leading manufacturer and marketer of engineered precision bearings and components, has attracted the attention of several institutional investors and hedge funds. Signaturefd LLC, Private Trust Co. NA, Allworth Financial LP, Advisors Asset Management Inc., and Eagle Bay Advisors LLC all purchased new positions in RBC Bearings during the first quarter of this year.

Signaturefd LLC made a strategic move by acquiring a position valued at $29,000. Private Trust Co. NA also entered the market with a new position valued at $39,000. Similarly, Allworth Financial LP seized an opportunity by purchasing a new position valued at $44,000. Advisors Asset Management Inc. allocated funds towards RBC Bearings with a value of $53,000. Finally, Eagle Bay Advisors LLC conducted an investment worth $56,000 to secure shares in RBC Bearings.

Shares of RBC stock commenced trading on Wednesday at $217.44. Over the past year, the stock has traded between a low of $195.18 and a high of $260.00. The company exhibits a favorable financial profile with a debt-to-equity ratio of 0.52 and solid liquidity ratios including a current ratio of 2.96 and a quick ratio of 1.05.

RBC Bearings boasts strong technical indicators as well. Its 50-day simple moving average sits at $219.04 while its two-hundred day simple moving average is slightly higher at $221.83.The company’s market capitalization stands at an impressive $6.26 billion with a price-to-earnings (PE) ratio of 40.49 which indicates positive investor sentiment towards the stock’s future performance.

With its focus on engineered precision bearings and components for both aerospace/defense and industrial applications, RBC Bearings caters to diverse markets in the United States and internationally.The company’s product portfolio includes plain bearings with self-lubricating or metal-to-metal designs, roller bearings such as tapered roller bearings and needle roller bearings, as well as ball bearings with high precision aerospace and industrial applications.

Market analysts have recently examined RBC Bearings’ potential, resulting in positive ratings for the company. Royal Bank of Canada upgraded its rating from “neutral” to “overweight,” while Alembic Global Advisors also raised their rating from “neutral” to “overweight” with a $267.00 price target. Truist Financial revised their price objective from $265.00 to $275.00 and rated the stock a “buy.” Meanwhile, Morgan Stanley increased its price objective from $286.00 to $294.00 and labeled the stock as “overweight.” Finally, Wells Fargo & Company adjusted its target price from $225.00 to $235.00 alongside an “equal weight” rating.

It is worth noting that available information suggests two analysts have issued sell ratings on the company’s stock, with two others providing hold ratings, while four analysts have assigned buy ratings to RBC Bearings.Clearly, there are varying opinions regarding the company’s future prospects which could influence investors’ decision-making process.

RBC Bearings continues to generate interest among institutional investors and hedge funds due to its strong financial standing, excellent technical indicators, and positive market sentiment reflected in analyst ratings.Transparency around this information can be attributed to sources like Bloomberg that provide comprehensive research reports on companies such as RBC Bearings Incorporated.

Reference: Bloomberg – Latest Research Report on RBC Bearings

Financial and marketing expert at Entrepreneur.com, covering finance, sales and marketing strategies. Proudly wearing 15 years of direct and managerial experience in intensive Digital Marketing and Financial Analytics.

Nothing on this website should be considered personalized financial advice. Any investments recommended here in should be made only after consulting with your personal investment advisor and only after performing your own research and due diligence, including reviewing the prospectus or financial statements of the issuer of any security.

The Best Stocks , its managers, its employees, affiliates and assigns (collectively “The Company”) do not make any guarantee or warranty about the advice provided on this website or what is otherwise advertised above.

Best Stocks to buy now Crypto Dow Jones Today Pre-IPO and Startups Tech stocks Utility Stocks

Data and Tools Stock Forecast Dow Jones Today

Follow us on Social Media Facebook – YouTube – Twitter

Write for us Finance – Business

Best Stocks to Buy Now

Roll Ball Bearing We are a financial media dedicated to providing stock recommendations, news, and real-time stock prices.